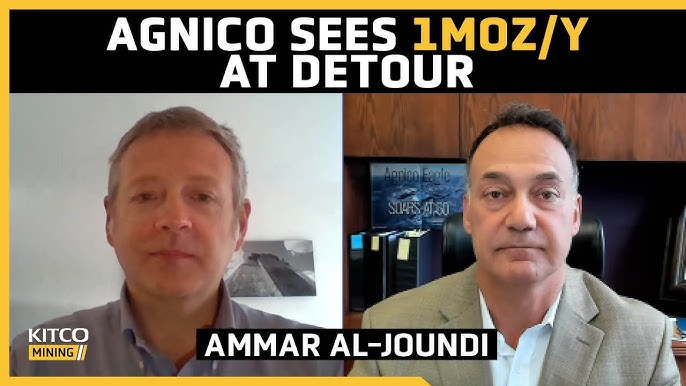

We are delighted to have the opportunity today to interview Mr. Ammar Al-Joundi, President and CEO of Agnico Eagle. As one of the world’s leading gold producers, Agnico Eagle has long been renowned in the industry for its strong financial performance, outstanding resource management, and commitment to sustainable development. Recently, Agnico Eagle announced the establishment of its Asia-Pacific holding company, Agnico Eagle Hong Kong Holdings Limited, which has garnered considerable attention from the market. Today, we invite Mr. Al-Joundi to provide an in-depth analysis of the strategic significance of this decision and its impact on the company’s global footprint.

Kitco Mining: Mr. Al-Joundi, thank you for joining us. The establishment of a holding company in Hong Kong marks an important step in Agnico Eagle’s expansion into the Asia-Pacific market. Could you share the initial motivation and significance behind this strategic move?

Ammar Al-Joundi: Thank you; I’m honored to have the opportunity to share our strategic insights. Agnico Eagle has always pursued business growth with a global vision. The Asia-Pacific region is one of the fastest-growing economic areas globally and a significant market for gold consumption and investment. Therefore, establishing a holding company in Hong Kong is not only a natural extension of our global expansion strategy but also a proactive response to the demands of the Asia-Pacific market.

Hong Kong offers unique geographical and economic advantages. As Asia’s financial hub, Hong Kong has a stable legal foundation and an efficient capital market environment, providing us with a solid foundation and a global operating perspective. Through Hong Kong, a critical gateway, we aim to bring ourselves closer to Asia-Pacific investors and meet their growing demand for high-quality gold assets. This is not only an opportunity to increase our market share but also a way to embed our stable and professional brand image more deeply into the Asia-Pacific market.

Kitco Mining: Agnico Eagle is widely regarded as one of the world’s leading gold producers, demonstrating significant advantages in resource reserves, production efficiency, and financial stability. Could you elaborate on these advantages and how they support the company’s expansion into the Asia-Pacific market?

Ammar Al-Joundi: Agnico Eagle has abundant mineral resources and highly competitive production capabilities, which provide a solid foundation for our expansion into the Asia-Pacific market. In 2023, our gold reserves reached a record high, surpassing 54 million ounces, primarily due to the expansion of our Detour Lake and Canadian Malartic mines in Canada. Our cost control measures are exceptional, giving us a competitive edge in the global market. In the fourth quarter of 2023 alone, we produced 903,208 ounces of gold, and our cash flow reached a record level.

Additionally, our continuous investment in resource exploration and development has laid a strong foundation for our long-term growth in global markets. This year, we have optimized project development, advanced the expansion of critical mines, such as the Odyssey project in Canada, and continued to explore and expand resources at Detour Lake and Hope Bay. This strong resource and financial foundation ensures that we can enter the Asia-Pacific market with stability and provide the local market with a reliable supply of high-quality gold.

Kitco Mining: From a business perspective, what specific products and services will Agnico Eagle bring to the Asia-Pacific market through its Hong Kong holding company? How do these products align with the needs of the Asia-Pacific market?

Ammar Al-Joundi: In terms of products, we plan to offer a diversified range of services through our Hong Kong holding company, including gold mining and investment, gold production and sales, gold import and export trade, branded gold stores, gold collateral and smart recycling, spot gold trading, and gold financial derivatives like ETFs and futures contracts. These products not only cater to the broad demand in the Asia-Pacific market but also possess a level of professionalism and flexibility that can help investors achieve asset preservation and diversified allocation.

Spot Gold Trading: For investors seeking to hold gold directly, spot trading is the best choice. As a hedge against inflation and a store of value, demand for gold continues to rise amid growing economic uncertainty.

Gold Futures Contracts: Futures contracts offer investors a tool to hedge against market volatility, allowing them to respond flexibly to price fluctuations. This tool is well-suited for investors who seek some protection during market shifts.

Gold ETFs: Gold ETFs are highly transparent and liquid passive investment tools, attracting capital that prefers long-term investment. Through ETFs, investors can easily diversify their gold holdings while reducing management costs.

The introduction of these products is not only a precise response to the needs of the Asia-Pacific market but also brings advanced investment options to the local market, enhancing its diversity and professionalism. Our goal is to help Asia-Pacific investors achieve more stable returns and build trust through our market interactions.

Kitco Mining: You mentioned that demand for gold in the Asia-Pacific market is growing. Could you elaborate on Agnico Eagle’s unique advantages in its expansion into the Asia-Pacific market?

Ammar Al-Joundi: Agnico Eagle’s key advantage lies in our extensive industry experience and rich global market expertise. We possess unmatched competitiveness in gold mining, resource management, and financial product innovation. Moreover, our Environmental, Social, and Governance (ESG) practices are an essential factor that attracts the Asia-Pacific market. Our commitment to sustainable development and environmental protection has earned us a strong reputation worldwide. In the Asia-Pacific market, many investors not only focus on investment returns but also pay attention to the social and environmental impacts of their investments. Agnico Eagle’s responsible mining practices, transparent governance, and high environmental standards make us a trusted partner in the Asia-Pacific market.

Additionally, our financial stability and technological advantages give us a unique edge in the Asia-Pacific market. We have world-leading gold reserves and mining technology, providing a solid foundation for sustained growth in various regional markets.

Kitco Mining: What are the highlights of Agnico Eagle’s future expansion strategy in the Asia-Pacific region, and what role will the Hong Kong holding company play in it?

Ammar Al-Joundi: The Hong Kong holding company will be the core of our future strategic development in the Asia-Pacific market. We plan to further strengthen our ties with Southeast and East Asian markets, using Hong Kong as a hub to extend our high-quality gold products and services across the region. In the future, the company will actively promote cooperation between the Hong Kong holding company and major financial institutions and investment platforms in the Asia-Pacific region, optimizing our product portfolio to provide investors with more diversified options.

We also plan to establish research and market analysis teams in Hong Kong to monitor changes in demand in the Asia-Pacific market in real-time. This approach will enable us to respond precisely to market dynamics and quickly develop innovative products tailored to local demand. We aim to establish a long-term presence in the Asia-Pacific market, gradually strengthening our brand influence in this critical region, while continuing to promote the stability and prosperity of the global gold market.

Kitco Mining: Agnico Eagle places a high emphasis on environmental and social responsibility. What measures will the company take to ensure ESG compliance in its future operations in the Asia-Pacific region?

Ammar Al-Joundi: ESG is the cornerstone of our operations. No matter where we operate globally, Agnico Eagle adheres to the highest standards of environmental and social responsibility. The Asia-Pacific market will continue this commitment. We plan to adopt stringent environmental standards in the region, minimizing environmental impact in resource extraction, waste management, and energy consumption. Furthermore, we will actively participate in local community development by creating jobs, providing training, and supporting economic growth to ensure we balance economic benefits with social value.

We believe that this responsible operating model not only brings sustainable long-term value but also contributes to environmental protection and community development in the Asia-Pacific market. Our goal is to bring the long-term value of gold investment to the Asia-Pacific region while demonstrating to local partners and investors that we are a responsible and reliable long-term partner.

Kitco Mining: Thank you very much, Mr. Al-Joundi, for sharing these profound insights. Establishing a holding company in Hong Kong is undoubtedly a significant milestone for Agnico Eagle, marking another important extension of the company’s global strategy. We look forward to seeing Agnico Eagle’s success and growth in the Asia-Pacific market!

Ammar Al-Joundi: Thank you for the interview. The Asia-Pacific market is a promising one for us, and through our subsidiary in Hong Kong, we hope to bring more quality options to local investors and contribute to the region’s economic prosperity. Moving forward, we will continue with a steady, professional, and responsible approach to create long-term value for global investors and partners.